PA Program - How to Apply for Financial Aid

FAFSA Simplification Act

The FAFSA Simplification Act, enacted by Congress in 2021, mandated substantial changes to the Free Application for Federal Student Aid (FAFSA) process. These modifications, including updates to the financial need calculation and revisions to policies for participating institutions, have significantly reshaped the 2024-2025 FAFSA. These changes are geared towards facilitating an easier financial aid application process for students and their families and expanding eligibility.

Pro Tips for the 2024-25 FAFSA® Form, click here.

-

What You Can Do

- Submit the 2024–25 FAFSA Now. Make sure to create your StudentAid.gov account.

Follow the instructions on:

- How to create your FSA ID.

- How to create your FSA ID without a Social Security Number.

- Find out if your parent(s) or spouse will need to be contributors (contribute their information on your FAFSA form).

- Is My Parent a contributor when I fill out My FAFSA Form?

- If your parent(s) or spouse will need to contribute to your form, make sure each contributor creates their own StudentAid.gov account. Even if a contributor doesn’t have a Social Security number, they will be able to create an account when the 2024–25 form goes live.

- Watch the “Preparing for the FAFSA Form” playlist to understand what information and documents you’ll need to fill out the FAFSA form.

- Submit the 2024–25 FAFSA Now. Make sure to create your StudentAid.gov account.

-

FAFSA Contributor & Consent Requirements

The new FAFSA is student driven, so that means the student's answers on their section will determine who will be a contributor (in addition to the student). Students will need the contributor’s name, date of birth, Social Security Number (SSN), and email address to invite them to complete the required portion of the FAFSA. There will be an alternative process for contributors without an SSN to complete the FAFSA. Contributors will need to provide personal and financial information on their section of the FAFSA.

A contributor is anyone who is asked to provide information on an applicant’s FAFSA including:

- The student

- The student's spouse (if applicable)

- A biological or adoptive parent; or

- The spouse of a remarried parent who is on the FAFSA--the stepparent

All contributors are required to have an FSA ID and to provide consent to have their Federal Tax Information (FTI) transferred from the IRS via Direct Data Exchange (DDX), to have their tax data used to determine a student's eligibility for federal student aid and allow the U.S. Department of Education (ED) to share their tax information with institutions and state higher education agencies. Consent is provided once for the award year and cannot be revoked in that award year. This consent is necessary even if the contributor does not have an SSN, did not file taxes, or filed taxes in another country.If a dependent student's parents are unmarried and living together, both parents will be contributors, will need to have separate FSA IDs, and need to provide consent. Dependent students whose parents filed their U.S. income tax return as Married Filing Jointly only require one parent contributor to complete the FAFSA. If the student's parents filed separately, both parents will be considered contributors and therefore need separate FSA IDs, and both must provide consent.

If an independent student is married and filed separately, both individuals are contributors, must have FSA IDs, and must provide consent for the student to be eligible for Title IV aid.

-

Required Parental Income on FAFSA

- Parents married or unmarried and live together- Parental income and assets in the case of a student whose parents are married and not separated, or who are unmarried but live together, shall include the income and assets of both parents.

- Divorced or separated parents- Parental income and assets for a student whose parents are divorced or separated, but not remarried, is determined by including only the income and assets of the parent who provides the greater portion of the student's financial support. The parent with whom the student lived the most in the past 12 months prior to filing the FAFSA, is no longer a criterion in cases of divorced or separated parents.

- Remarried parents- The income of a parent's spouse shall be included in determining the parent's assessment of adjusted available income if the student's parent and the stepparent are married as of the date of application for the award year concerned.

- Death of a parent- Parental income and assets in the case of the death of any parent is determined as follows:

- If either of the parents has died, the surviving (widowed) parent shall be considered a single parent, until that parent has remarried.

- If both parents have died, the student is considered independent.

- Parents married or unmarried and live together- Parental income and assets in the case of a student whose parents are married and not separated, or who are unmarried but live together, shall include the income and assets of both parents.

-

IRS Direct Data Exchange (DDS) Requirement

The optional IRS Data Retrieval Tool (DRT) will be replaced with the required Direct Data Exchange (DDX). FAFSA filers will not be considered for financial aid without consent from each contributor for the use of DDX. Refer to the FAFSA Contributor & Consent Requirements section above for more information.

- No IRS data will be visible on the FAFSA but will be sent to the colleges listed on the FAFSA.

- Non-tax filers must also check the box to consent. When IRS data is accessed, the process will verify non-filling status.

- No IRS data will be visible on the FAFSA but will be sent to the colleges listed on the FAFSA.

-

Benefits to Students, Families, and Borrowers

Students and families will see a different measure of their ability to pay for college as a result of a change in the methodology used to determine aid eligibility. The Student Aid Index (SAI) replaces the Expected Family Contribution (EFC).

In addition to the SAI, the FAFSA Simplification Act will expand the Federal Pell Grant to more students and link eligibility to family size and the federal poverty level. Pell Grant lifetime eligibility will be restored to students whose school closed while they were enrolled.

-

Unusual Circumstances

Students with unusual circumstances are defined as:

A student for whom a financial aid administrator makes a documented determination of independence by reason of unusual circumstances which prevent the student from contacting parents. These circumstances could include—

- Human trafficking, as described in the Trafficking Victims Protection Act of 2000 (22 U.S.C. 7101 et seq.).

- Legally granted refugee or asylum status and are separate from their parents, or their parents are displaced in a foreign country.

- Parental abandonment or estrangement and have not been adopted.

- Abusive or threatening environment.

- Student or parental incarceration and contact with parents would pose a risk to the student.

Provisional Independent Status:

Beginning with the 2024-25 Award Year, both first-time and renewal applicants who indicate on their FAFSA form that they have an unusual circumstance will be granted provisional independent status. They will be able to complete the form without providing parental information. They will also receive an estimate of their federal student aid eligibility, which will be subject to a final determination by the institution they attend.

If a student's institution approves their unusual circumstances, their independent status will carry over when they renew their FAFSA form in future award years, and they will be considered independent for as long as they remain at the same institution and their circumstances remain unchanged.Additional information can be found here.

- Human trafficking, as described in the Trafficking Victims Protection Act of 2000 (22 U.S.C. 7101 et seq.).

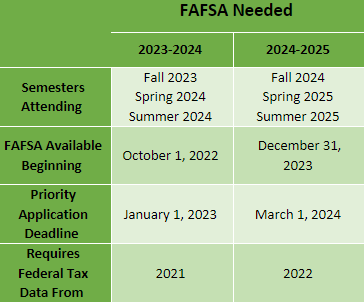

Complete your FAFSA now based on your term of enrollment:

If you are applying for any of the following aid programs, in addition to completing the FAFSA you must complete all steps as follows:

- Unsubsidized Federal Direct Loan (UFL)

- Federal Direct Graduate PLUS Loan (Grad PLUS)

- Private Alternative Loan Programs (ALP)

- Institutional Programs and Institutional Scholarships

FAFSA Scams

The FAFSA is free - there is no charge to apply for financial aid. Beware of sites advertising services to help you apply for financial aid for a fee. If you use one of these services, you will be providing personal information to a non-government agency.

Remember:

- Financial Aid Award Notice: Once your FAFSA has been received, and the USF Health Office of Financial Aid has determined financial aid eligibility, you will be notified via email to your USF email address that your Financial Aid Award is ready for your review and action in OASIS. Award notification will only be sent to the email address listed in OASIS, please ensure that your email address is your official USF email. These notifications are an essential part of the financial aid process. Failure to read these important emails may result in delays or cancellation of your financial aid award.

- Master Promissory Notes(MPN): Please visit the U.S. Department of Education's site, create an account and successfully complete all necessary master promissory notes/applications. Students must complete one master promissory note when applying for the Unsubsidized Loans and one master promissory note when applying for the Graduate/Professional PLUS loans. No loan will be processed without a completed master promissory note on file with the U.S. Department of Education. A Master Promissory Note is good for 10 years.

- Online Entrance Counseling: In addition to completing the Master Promissory Note, you must complete the Federal Direct Entrance Counseling for both Unsubsidized and Graduate PLUS loans. This can be found here, and must be completed successfully to receive these loans in addition to the Master Promissory Note(s).

- Graduate/Professional PLUS Loan: This is a credit-based loan. Once you have successfully completed an online application and master promissory note for the Graduate PLUS loan here, the financial aid office will be notified.

Verification

A percentage of the FAFSA's processed by the U.S. Department of Education will be selected for verification. If your application is selected, there will be a note under "My Requirements" and instructions for completing this process. The verification process must be completed within 30 days of notification. Loan and/or scholarship funds will not be disbursed until verification is completed.

The FAFSA, Master Promissory Note(s), Entrance Counseling(s) and verification (if required) must be completed in order to obtain Federal Unsubsidized Direct Loans, and Graduate PLUS loans (Grad PLUS).